4 min read

Sequence Of Returns Risk: How WHEN You Retire Could Make or Break Your Retirement Portfolio

By: RL Wealth Partners Jan 25, 2019 6:00:58 PM

What is Sequence Risk?

Sequence risk is also called sequence-of-returns risk. It becomes a danger as an individual takes withdrawal from their retirement savings. The order or the sequence on annual investment returns is a primary concern for retirees who are living off the income and capital of their investments.

Breaking Down Sequence of Returns Risk

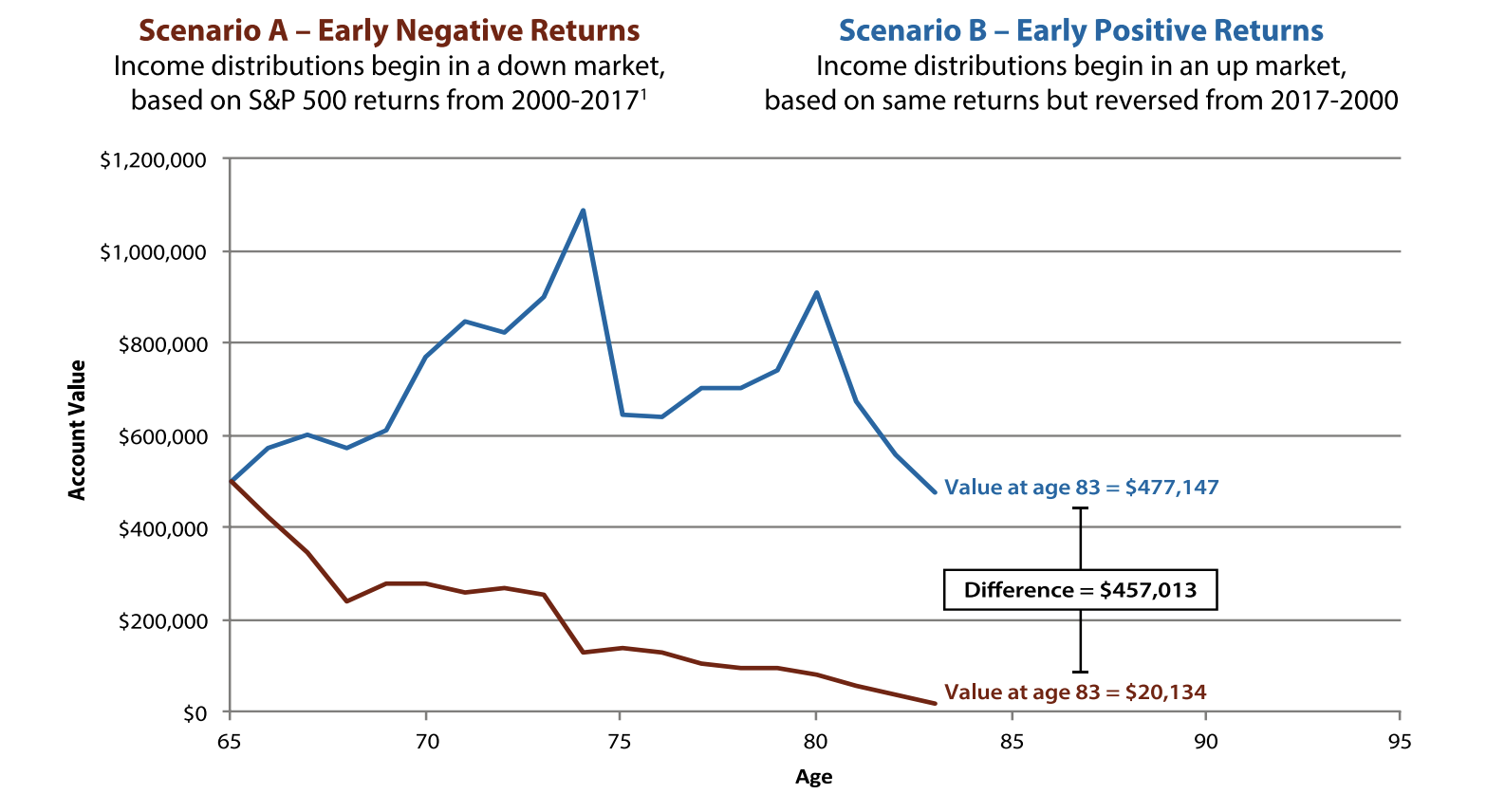

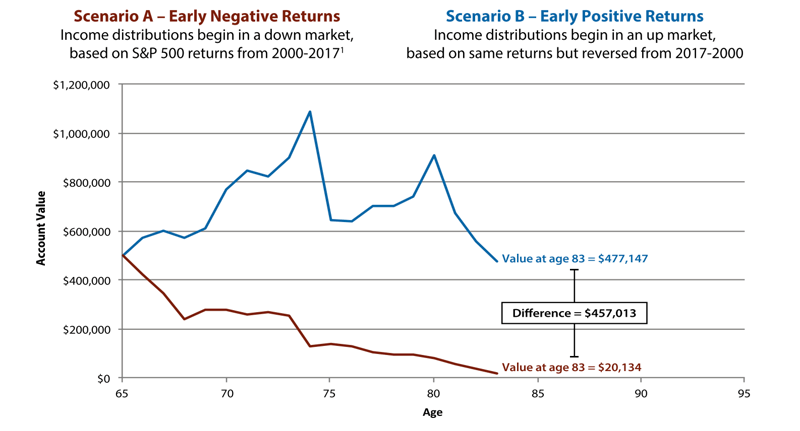

As you will see in the graphs below, the timing of negative returns can have a dramatic and negative impact to one's retirement savings.

Early Negative Returns vs. Early Positive Returns

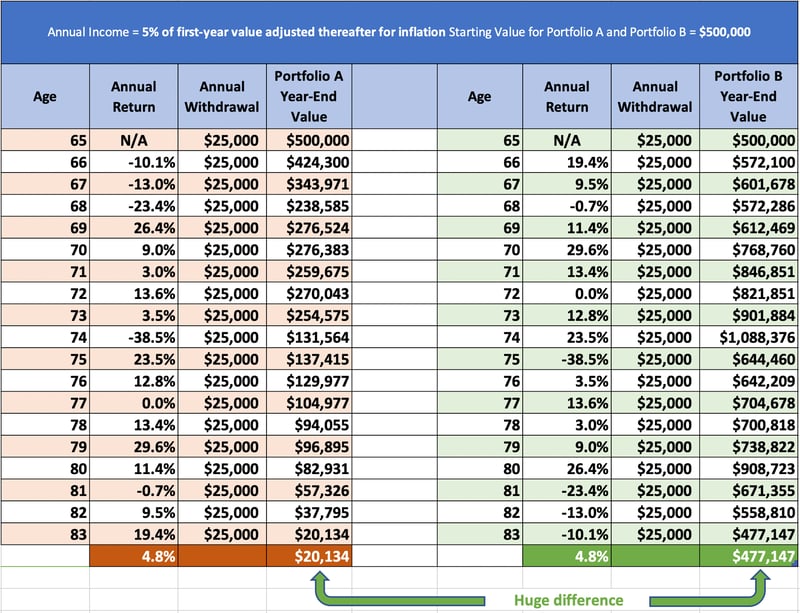

Let's say Steve, age 65, has $500,000 in savings invested in an index fund that mirrors the performance of the S&P 500. He begins to withdraw 5% each year for income. Compare the difference in his portfolio balance in the graph below. In each scenario, the average annual rate of return is 4.95 percent.

But starting withdrawals in years with negative returns yields a very different portfolio outcome than when withdrawals begin in years with positive returns.

At age 83, Steve has only $20,134 left in account value (scenario A), when withdrawals began in a negative market. In scenario B, Steve has $477,147 in account value after 18 years, a difference of $457,103!

More portfolio account value is preserved when withdrawals begin in years with positive returns.

1 - Source: Standard & Poor's Financial Services LLC (S&P), a subsidiary of The McGraw-Hill Companies, Inc.

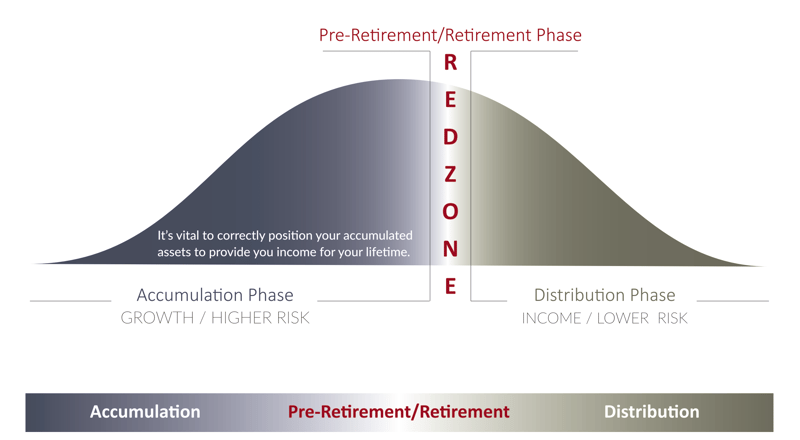

Why Sequence of Returns Risk is Important To Understand When In the Retirement Red Zone

The danger comes when an investor receives lower or negative returns and at the same time is taking withdrawals to meet their income needs. Financial outcomes can be dramatically different depending on when and how a person begins their retirement days.

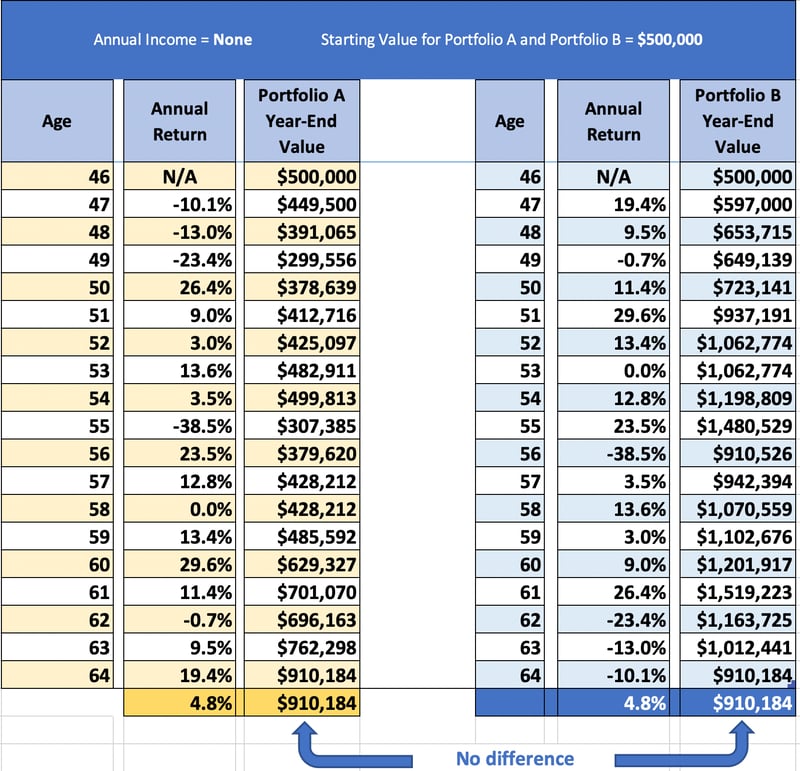

Investors cannot predict what the market will do or not do. If you are younger and saving in the accumulation phase, you will have time on your hands and most likely be able to weather the storm:

On the other hand, as you can see below with the comparison of retiree A (red) and retiree B (green), the value of their principle balance while in a distribution phase is very different:

How can you protect your retirement assets against Sequence Of Returns Risk?

Retirees can act to mitigate sequence of returns risk, such as allocating assets to different type of accounts and securing future guaranteed income from the use of insurance products. Think of this as creating your own pension.

While understanding sequence of returns risk is important, it may not be THE MOST important part of your retirement plan right now.

In our 365 Retirement Plan process, the first step is all about you — your concerns, your dilemmas, and your ultimate wish list for retirement.

This thorough question-and-answer session is dedicated solely to you, and will help us create a solid foundation on which to build our second step in the process.

Request a 15 min. strategy call today and discuss your situation with one of our partners.

The examples shown are hypothetical, are used for illustration purposes only, and do not take into account other sources of retirement income. It is not recommended that one invests 100% of assets in one type of account. Past performance is not an indication of future results.

Three Types of Investment Accounts & How They May Affect Your Retirement Income

This week’s blog is a homage to a book that we’ve been giving to people who come in for a...